income tax rates 2022 australia

6 rows Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax. In the long-term the Australia.

Australia Income Tax Cuts Here S How Much You Could Get Back In 2020 7news

Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000.

. C for every dollar over. Tax Rates 2020-2021. An FBT rate of 47 applies across these years.

29467 plus 37 cents for each 1 over. Australian income is levied at progressive tax rates. 2019-2020 State Income Tax Rates Sales Tax Rates and Tax Laws.

Base rate entity company tax rates The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later. 325c for every dollar between - 0. Taxable income range Marginal income tax rate 2018-19 to 2021-22 2022-23 to 2023-24 2024-25 onwards 0 0 18200 0 18200 0 18200.

Income tax rate and will provide a minimum net tax benefit of 85 with a premium tier of 165 for an RD spend with an intensity exceeding 2. Personal Income Tax Rate in Australia is expected to reach 4500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. 37c for every dollar between - 180000.

About 10 tax on a 100 purchase. Taxable income Tax rate Taxable income Tax rate Taxable income Tax rate Taxable income Tax rate. There are seven federal income tax rates in 2022.

Two further incentive regimes are proposed. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1. 5 rows Low and Middle Income Tax Offset LMITO income tax rates and thresholds for 2022.

Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500. Income thresholds Rate Tax payable on this income. 19 cents for each 1 over 18200.

Fringe benefits tax - historical rates. Taxable income Tax on this income. Australia Residents Income Tax Tables in australia-income-tax-system.

Also as part of the 3-step plan the Government has increased the existing Low Income Tax Offset LITO from AUD 455 to AUD 700. 19c for every dollar between 18201 - 0. Australia has a bracketed income tax system with five income tax brackets ranging from a low.

VAT and Sales Tax Rates in Australia for 2022. No tax on income between 1 - 18200. Further under the Governments initiative the LITO will be recovered at a lower rate of 5 cents per dollar for taxable incomes between.

Tax Rates for 2022-2023. Australia VAT Rate 1000. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The Australian government has implemented a seven-year Personal Income Tax Plan aimed to provide tax relief to individual taxpayers through lower PIT rates and Low and. The top marginal income tax rate. The LITO will be recovered at a rate of 5 cents per dollar.

This is expected to take effect from 1 July 2022. FBTFringe benefits tax FBT rates and thresholds for employers for the 201819 to 202223 FBT years.

Capital Gains Tax Spreadsheet Australia Budget Spreadsheet Excel Spreadsheets Templates Spreadsheet Template

Income Tax Cuts Calculator Australia Federal Budget 2020 21

Australia Medicare Card Template In Psd Format Fully Editable Gotempl Templates With Design Service In 2022 Templates Online Activities Medicare

Australian Income Tax Brackets And Rates For 2021 And 2022

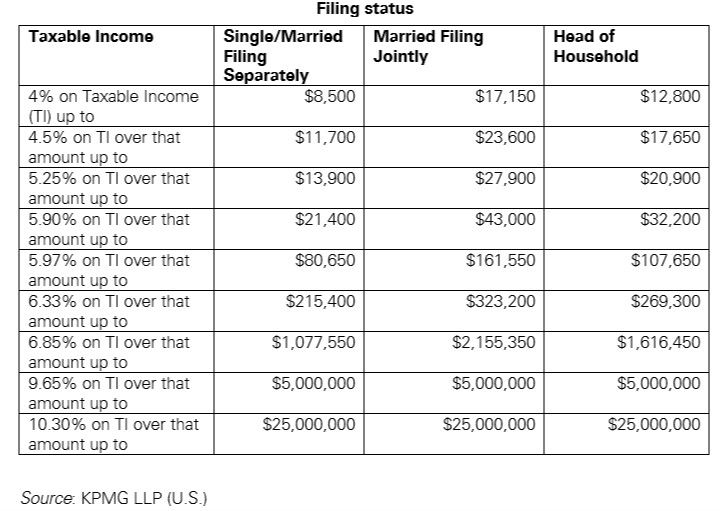

Us New York Implements New Tax Rates Kpmg Global

How Can Hr Help Independent Contractors Properly File Income Taxes In 2022 File Income Tax Profit And Loss Statement Filing Taxes

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

Australia Crypto Tax Guide 2022 Koinly

Simple Spreadsheets To Keep Track Of Business Income And Expenses For Tax Time Etsy Shop Critique Organization Planner Printables Spreadsheet Template

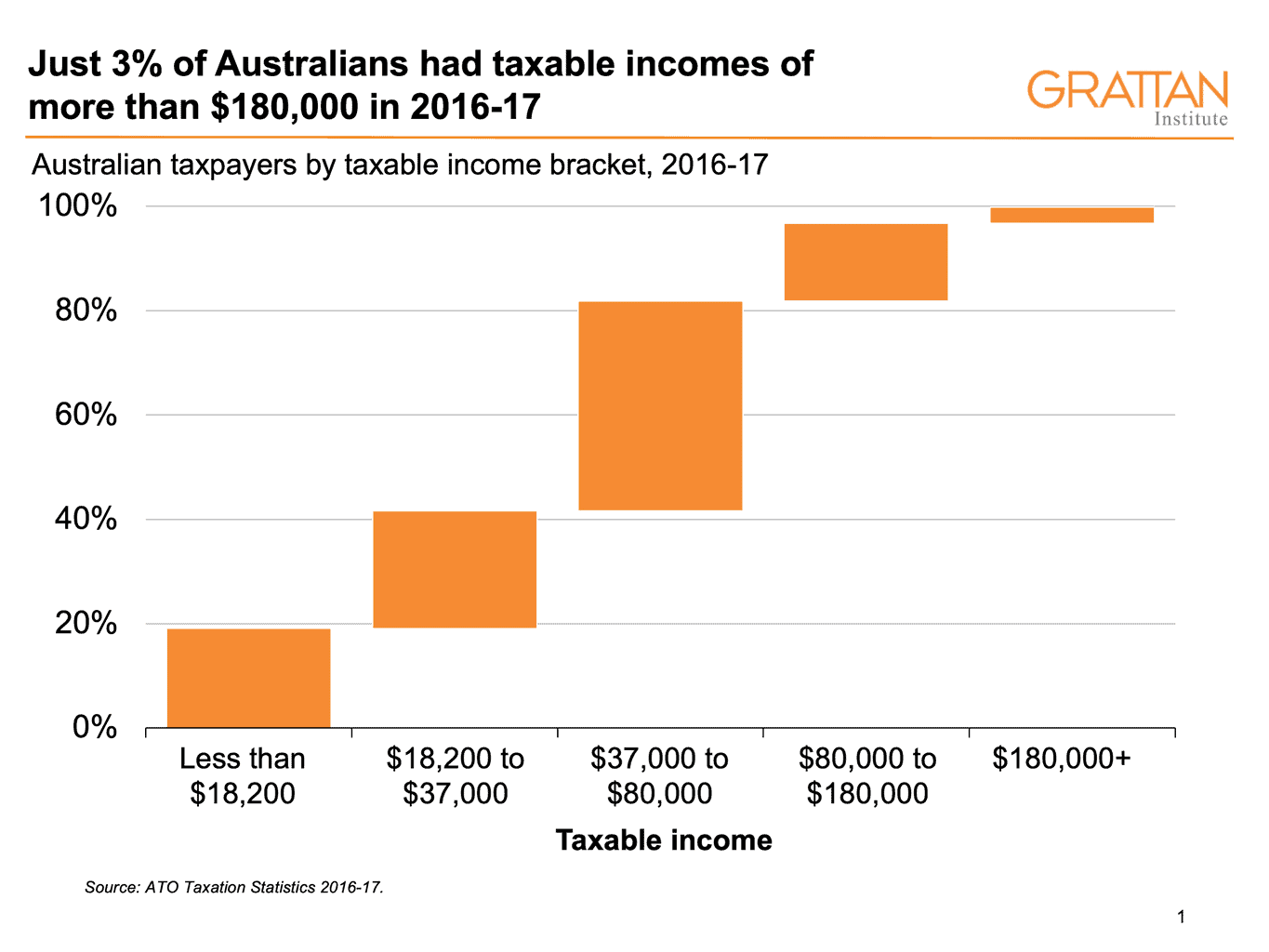

How Much Does The Typical Australian Earn The Answer Might Surprise You Grattan Institute

H R Block Tax Return Australia Sydney Branding Poster Design Graphic Illustratio Design Rivista Design Per Rafforzare L Identita Design Brochure

The Nice Reset In Asset Returns Commodities Hovering Treasuries Tanking House Value Deve In 2022 Asset Investing Balance Sheet

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Personal Income Tax Cuts 2018 2025 What It Means For You

2020 Income Tax Withholding Tables Changes Examples Income Tax Federal Income Tax Income

Payroll Taxes Are Taxes Which Are Imposed On Employers When They Pay Employees And On Employee Wages By Federal State And In 2022 Llc Taxes Business Tax Payroll Taxes

Australia Macquaire Proof Of Address Bank Statement Template In Word And Pdf Format Doc And Pdf Datempl Tem In 2022 Statement Template Bank Statement Templates